07 February, 2022

Switch Delhi - Accelerating Fleet Electrification: What We Are Learning From Delhi

Akshima Ghate & Dimpy Suneja

Delhi has one of the most progressive and holistic subnational EV policies in the country, which has become a role model for other states. With an ambitious target of electric vehicles reaching 25 percent of new vehicle registrations in 2024, the policy focuses on electrification of shared and commercial transport.

Delhi has one of the most progressive and holistic subnational EV policies in the country, which has become a role model for other states. Just over one year after its implementation, the policy is already providing the necessary impetus to accelerate the much-desired transition to EVs and achieve thresholds that can trigger mass uptake.

With an ambitious target of electric vehicles reaching 25 percent of new vehicle registrations in 2024, the policy focuses on electrification of shared and commercial transport. Since notification of the policy in August 2020, there have been efforts to encourage fleet operators and on-demand service mobility providers to transition to EVs. Besides implementing purchase incentives that have made commercial EVs competitive with internal combustion engine (ICE) vehicles, the Delhi government has also been implementing regulatory reforms that would make EVs a preferred choice for operators. For example, the Delhi government recently stated that electric light goods

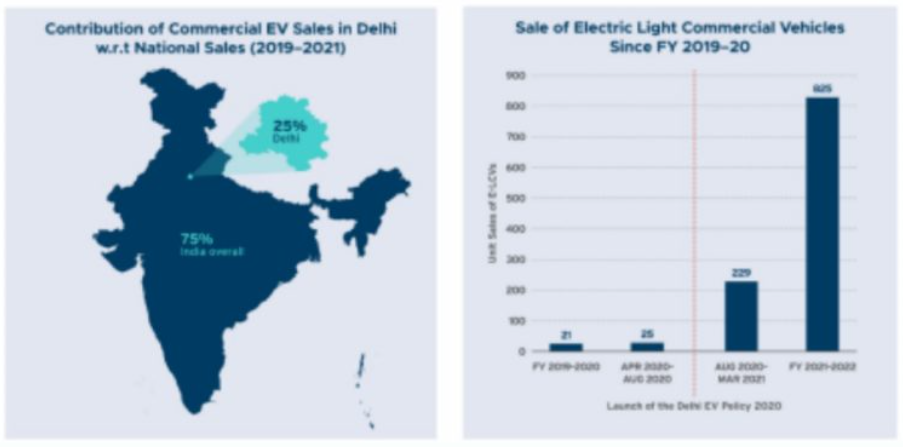

vehicles (L5N and N1 categories with a gross vehicle weight of 1.5 tons and 3.5 tons, respectively) will be allowed to drive in Delhi even during restricted hours, a move hailed by the industry and expected to give a competitive edge to EVs over ICE vehicles. These fiscal and non-fiscal measures are starting to trigger the growth of commercial EVs, a market that was non-existent before Delhi’s EV policy. Commercial electric vehicle sales have been the highest ever after implementing the policy. Delhi has contributed to 25 percent of electric commercial vehicles sales in the country since 2019 (785 electric taxis out of the 1,609 units sold nationally and 1,068 electric goods carriers out of 4,035 units sold nationally).

EV sales Delhi

The Delhi EV Policy offers the purchase and scrapping incentives over and above the incentives offered to EVs under the FAME-India phase-II scheme. Thus, OEMs and operators have been gearing up to initiate or expand their operations in Delhi. According to RMI estimates, the demand incentives under the Delhi EV Policy combined with the exemption of road tax and registration fees on EVs reduce the cost of owning and operating electric three-wheelers and electric taxis by approximately 26 and 35 percent respectively.

The incentives under the Delhi EV Policy make the total cost of ownership (TCO) of commercial EVs highly competitive with ICE vehicles. The fiscal incentives complemented with non-fiscal provisions such as exempting them from the driving and idle parking restricted hours, granting permits to operate electric two-wheelers for ride-hailing purposes (e-bike taxis), and providing financing schemes further make e-commercial vehicles an attractive proposition for fleet and logistics companies.

Delhi’s experience and success so far are providing useful insights into measures that can help accelerate fleet electrification in Indian cities. The ease of accessing incentives and the deep engagement with and awareness programs for the industry are some of the key government efforts that have been instrumental in creating interest among fleet operators in fleet electrification while giving them the confidence to initiate and expand operations in Delhi.

Ease of accessing demand incentives: Several studies have found that consumer responsiveness is low if the incentives (or discounts) are distributed more than two weeks after purchasing the vehicle. Therefore, the Delhi government developed a user-friendly and transparent digital platform that ensures disbursement of demand incentives within 10 days of requisition. The easy and timely disbursement of incentives is complemented with a quick redressal mechanism to ensure minimal consumer grievances.

Government’s commitment to clean mobility: The Delhi government has been leading the clean mobility transition by example. It has mandated that all government-owned, leased, or hired ICE vehicles are replaced with electric vehicles starting in February 2021. The hired/leased ICE vehicles by all government departments, grantee institutions, and autonomous bodies of the Delhi government are to be converted to EVs by the end of their contract/agreement. The commitment to this transition not only creates and assures demand to industry, but it also has a demonstrative effect that can inspire others to adopt EVs. As the Delhi government transitions to electrify its existing fleet, it is expected to create a demand for nearly 2500 vehicles.

Continuous engagement with industry: The Delhi government has been continuously engaging with the industry to gather insights on challenges to the deployment of commercial EVs. Discussion forums like the Delhi EV Forum and the Switch Delhi Campaign have helped address the industry’s day-to-day operational challenges regarding the adoption of EVs in a timely manner.

Deployment of charging infrastructure: Because the installation of captive charging stations to support fleet operations can be an extremely cost-intensive proposition for aggregators, the Delhi government has put forth India’s largest tender for deploying public charging infrastructure. This can potentially reduce the dependence of fleet operated vehicles on dedicated captive charging stations. The tender ensures that operators will be provided with a preferential EV tariff and incentivizes the capital expenditure through defraying costs associated with land rentals and upstream electrical infrastructure.

Promoting financing options for EVs: To address the limited availability of electric vehicle financing, the policy provides a 5 percent interest subvention to commercial EVs. To implement this provision, the Delhi government has facilitated several discussions between fleet aggregators and financial institutions. An important outcome of these discussions is to create a First Loss Default Guarantee fund pool to further encourage financial institutions to finance the purchase of EVs by sharing the risk of defaults.

Skill development of technicians and EV staff: Currently, fleet operators must take the onus of training their drivers and technicians. The Delhi government has adopted a two-pronged approach by ensuring the skill development of this personnel. It plans to create a robust after-sales service network to suit the needs of the growing EV fleet by providing these vocational training programs through its World Class Skill Centers. The reduced cost of skill development will work positively for the TCO of fleet operation.

All of these measures give the right signals to fleet operators to initiate and/or expand commercial EV operations in Delhi. The transparent and rapid process of disbursing demand incentives, the government commitment to engage industry, and the measures to support charging infrastructure deployment, financing, and skill development have triggered the commercial EV market in the city.

If the trends of EV adoption over the past 1.5 years continue along with the implementation of the various provision of the EV Policy, Delhi could reach almost 30 percent commercial EV sales by 2025 and 70% by 2030, which in turn would provide impetus to the EV industry and operations in Delhi and beyond. Delhi’s experience provides useful and critical lessons for other states and cities to help trigger a mass deployment of EVs for fleet operations.

Disclaimer: The views and opinions expressed in this article are solely those of the original author. These views and opinions do not represent those of The Indian Express Group or its employees.